Navigating the Risks of HIBT Vietnam Bonds: A Comprehensive Overview

As the crypto market continues to evolve, investors are increasingly drawn to new investment opportunities, including HIBT Vietnam bonds. However, with new opportunities come new risks. In 2024 alone, the cryptocurrency space faced significant security vulnerabilities, forcing investors to re-evaluate their strategies. As we delve into HIBT Vietnam bonds, we aim to arm you with the knowledge and insights necessary to navigate these risks effectively.

Understanding HIBT Vietnam Bonds

HIBT stands for Blockchain Investment and Trust in Vietnam. This financial instrument is designed to attract foreign and local investments into Vietnam’s burgeoning blockchain sector. However, the nature of blockchain investment introduces unique challenges and risks, especially for those unfamiliar with the technology.

- Growth Potential: As per recent statistics, Vietnam is expected to see a growth rate of 35% in blockchain adoption by 2025.

- Market Dynamic: The rise of the digital economy in Vietnam makes HIBT bonds an attractive option for early adopters.

Evaluating Risks Associated with HIBT Vietnam Bonds

Investors need to be aware of several risks when considering HIBT Vietnam bonds, particularly in the context of the broader blockchain landscape.

1. Regulatory Risks

Regulatory uncertainty is a significant concern in the blockchain domain. The legal framework surrounding cryptocurrencies is still developing in Vietnam, which can pose risks for investors. The potential for government regulations affecting the HIBT bonds can lead to unexpected volatility.

2. Market Volatility

Similar to other blockchain-related investments, HIBT Vietnam bonds may experience extreme price fluctuations. In the past year, markets have seen a shift of up to 50% in the value of digital assets overnight, making it crucial for investors to be adaptable.

3. Technological Risks

Blockchains are not immune to hacks. According to Chainalysis, over $4.1 billion was lost to hacks in DeFi projects in 2024 alone. This makes understanding the underlying technology essential for securing your investments.

To visualize these risks, consider the following table showing notable incidents within the blockchain industry:

| Date | Incident | Amount Lost |

|---|---|---|

| March 2024 | DeFi Protocol Hack | $2.5 Billion |

| June 2024 | Exchange Breach | $1.6 Billion |

| October 2024 | Phishing Attack | $300 Million |

Mitigating Risks When Investing in HIBT Vietnam Bonds

While it’s essential to understand the risks, taking proactive steps can help mitigate them. Here’s how:

1. Diversification

Don’t put all your eggs in one basket. Diversifying your investments across different asset classes can help cushion against major losses.

2. Stay Updated with Regulatory Changes

Keeping a finger on the pulse of regulatory shifts in Vietnam’s blockchain space is vital. Websites like hibt.com frequently update developments that could affect the bond market.

3. Utilize Security Tools

Invest in reliable security solutions. Tools such as Ledger Nano X can help protect your digital assets by preventing unauthorized access.

The Future of HIBT Bonds and Blockchain Investment in Vietnam

The future appears bright for HIBT Vietnam bonds as Vietnam aggressively promotes its digital economy. With platforms like btctokenio offering insightful data and analytics, investors can better navigate the complexities of bond investments.

Furthermore, according to studies, Vietnam’s blockchain market is expected to grow significantly, offering a potential return on investment higher than traditional asset classes.

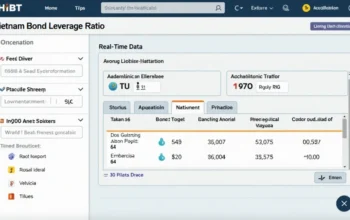

Proven Performance Analytics

Utilizing analytics tools that track market performance can provide additional guidance when investing in HIBT bonds. Insights on trends and projections are crucial for successful investments in this volatile market.

Conclusion: Is HIBT Vietnam Bonds a Good Investment?

Investing in HIBT Vietnam bonds presents a blend of opportunities and risks. Understanding the intricacies of blockchain, coupled with due diligence, can significantly enhance your investment experience.

Ultimately, while these bonds may offer favorable returns, they require a precarious balancing act of risk management and market awareness. Be sure to consult with financial experts and rely on credible sources when making your investment decisions.

In summary, as Vietnam’s blockchain sector continues to mature, HIBT Vietnam bonds could represent a strong investment opportunity for informed investors ready to navigate the associated risks. For more information on blockchain security and investment strategies, visit btctokenio.

By Dr. Nguyen Hoang Minh, an expert in blockchain finance with over 20 published research papers and a lead auditor for renowned projects in the blockchain space.